RVNU #029: The Enterprise Scaling Chasm

Why B2B SaaS Organizations Fail to Scale Beyond Startup Operations

[STAGE: 14-16]

[PROBLEM: Organizational Scaling and Systematization]

[FOR: Technical Founders/B2B SaaS Companies]

[TOPIC: Operational Scale Challenges]

Introduction

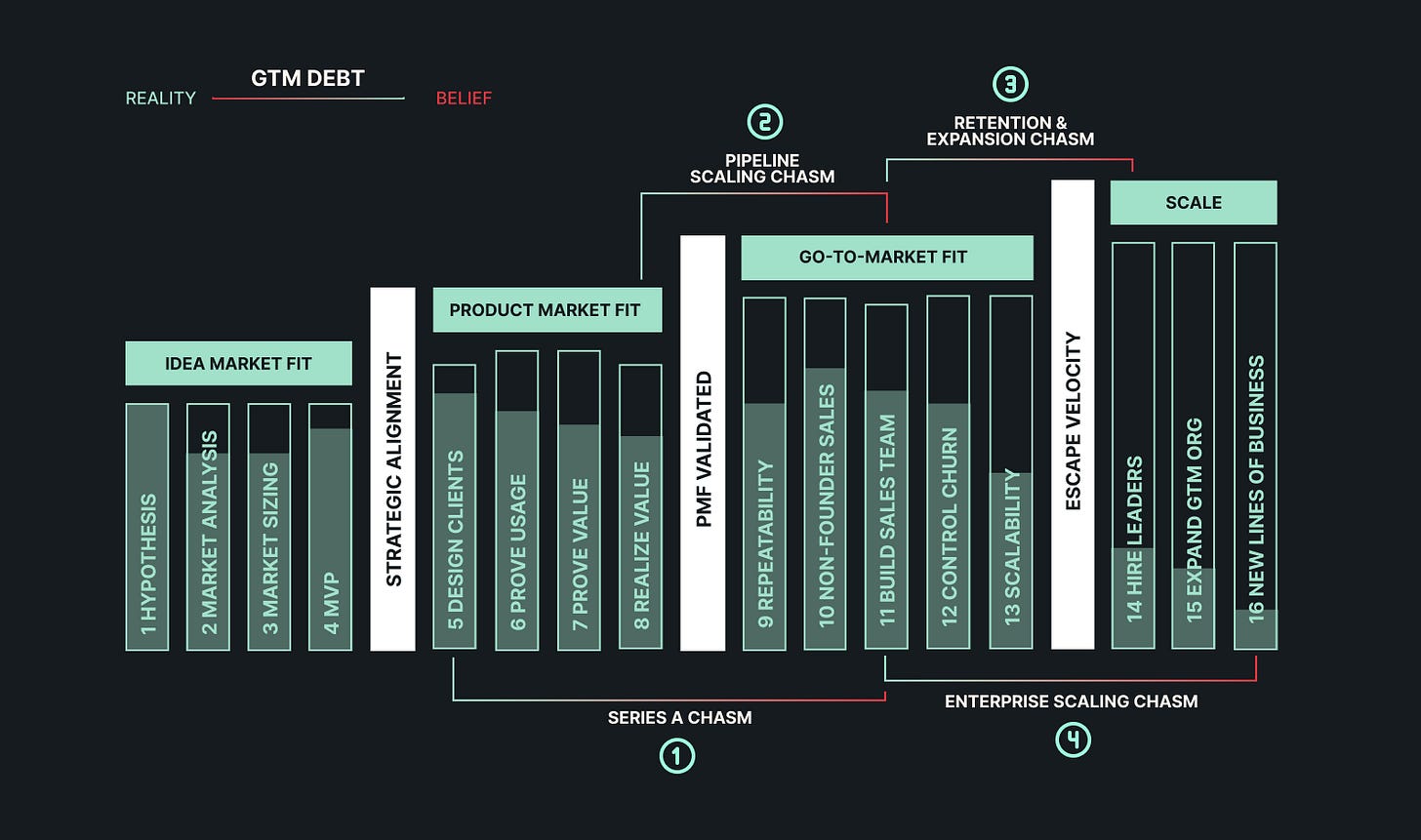

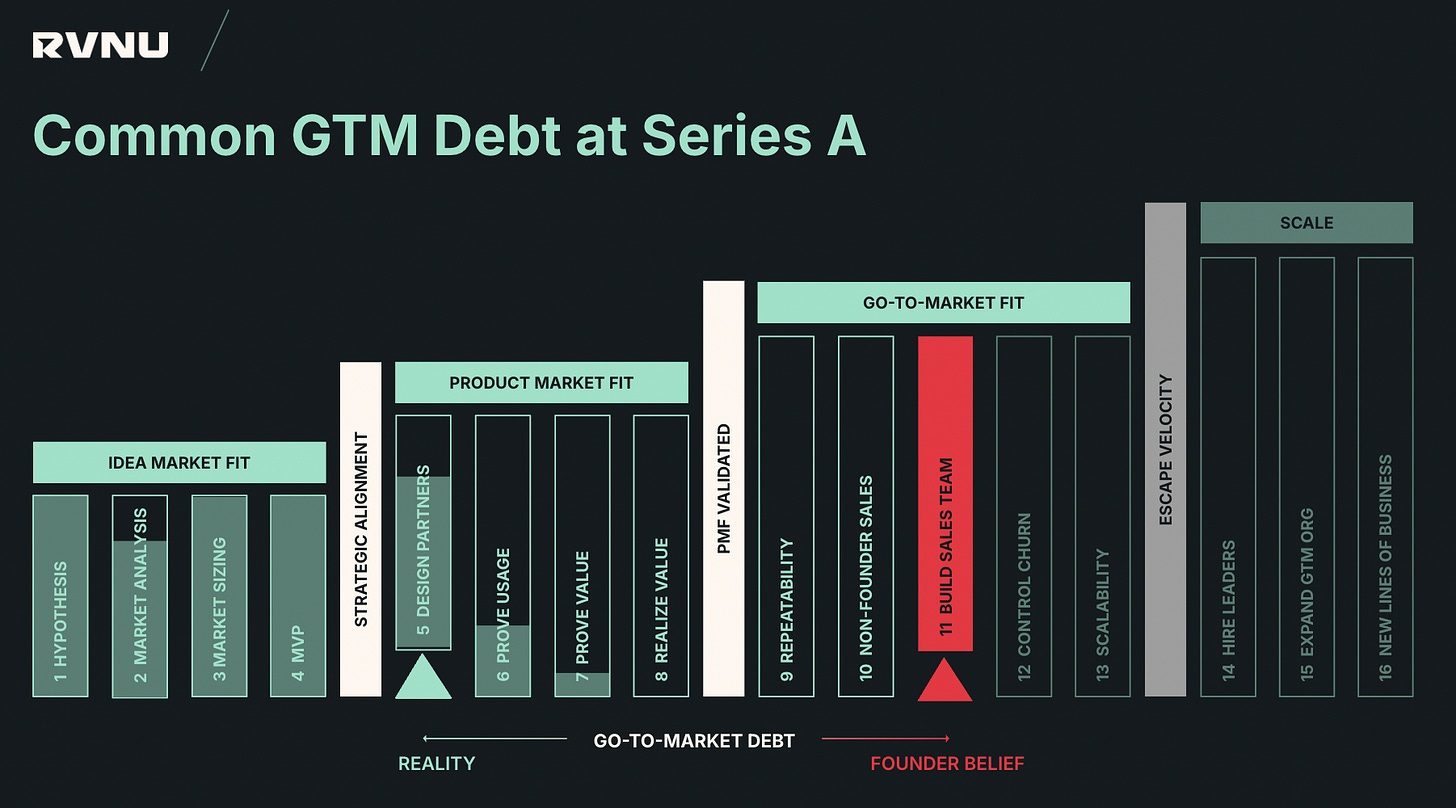

This is the 4th and final newsletter in the “4 Growth Chasms” series, and it’s the one that stands in the way of a major exit.

This is the stage founders are forced to be intellectually honest about how much of the startup’s success is down to their magic and how much of it is down to their team. More often than not founders realize they are responsible for much more of the success than they give themselves credit for, and rather than see growth accelerate, growth begins to slow.

In this newsletter, we’ll explore the problem in more detail, how it impacts startups, some principles to consider to avoid ending up here, some market observations we are seeing, and guidance by stage of growth to avoid falling into this chasm.

The Challenge

As B2B SaaS companies reach $10M+ ARR and achieve product-market fit within their target segments, many founders encounter an unexpected obstacle: the organizational structures and processes that enabled initial growth become constraints to scaling further.

Our research identifies that 68% of teams fail to evolve for sustained growth at scale, finding their startup operations fundamentally inadequate for managing larger, more complex organizations, and I have witnessed this in person as an operator.

This transition—the Enterprise Scaling Chasm—typically emerges as companies attempt to systematize operations, hire senior leadership, and expand into new markets.

Problem Exploration

The Executive Leadership Integration Challenge

[PROBLEM_ASPECT: Difficulty transitioning from founder-led to executive-led operations]

Most B2B SaaS companies begin with founders making most critical decisions through direct involvement and informal coordination. At RVNU we heavily promote this approach.

The Enterprise Scaling Chasm emerges when the complexity of operations exceeds what founders can effectively manage, requiring the integration of senior executives who can operate independently while maintaining strategic alignment.

This challenge manifests in several ways:

Difficulty attracting executive talent who can operate in less-structured environments

Integration challenges as new executives attempt to implement processes in founder-centric cultures

Role confusion and authority conflicts between founders and hired executives

Resistance from early employees to new management layers and formalized processes

Loss of organizational agility as structure increases

The transition from founder-led to executive-led operations represents one of the highest-risk periods for growing companies. In truth, many founders and operators who enjoy building versus scaling point to this moment as the optimal time for them to step away from the business. But for founders especially, that is rarely a realistic option

The Organizational Systematization Gap

[PROBLEM_ASPECT: Informal processes inadequate for scaled operations]

Companies that achieved initial success through entrepreneurial hustle and informal coordination often struggle to systematize operations for larger teams and more complex customer bases. This creates fundamental execution challenges as the organization attempts to maintain quality and consistency at scale.

Key symptoms include:

Inconsistent execution across different teams and functions

Knowledge concentrated in key individuals rather than documented processes

Decision-making bottlenecks as founders become overwhelmed

Quality control challenges as teams expand beyond direct oversight

Difficulty scaling customer success and implementation processes

Companies successfully navigating rapid growth typically invest significantly more in process development and knowledge management at around the 25 person/$4M ARR point in SaaS (in my experience) compared to those that struggle with operational scaling, though the optimal balance varies by company culture and market dynamics.

The Strategic Focus Dilution

[PROBLEM_ASPECT: Expansion efforts undermine core business performance]

As companies achieve success in their initial markets, they often face pressure to expand into adjacent opportunities—new customer segments, product lines, or geographic markets. However, without proper organizational maturity, these expansion efforts frequently dilute focus and resources from core business operations.

This dilution typically reveals itself through:

Core business metrics declining as resources shift to new initiatives

Confusion about priorities and resource allocation across the organization

Cultural fragmentation as different teams pursue different objectives

Integration challenges between new and existing business lines

Loss of competitive advantage in core markets due to divided attention

Companies maintaining strong core business performance while expanding typically achieve significantly better outcomes compared to those where expansion efforts compromise core operations.

Common Misconceptions

"Hiring experienced executives will automatically solve scaling challenges"

[MISCONCEPTION]

When organizational challenges emerge, many founders default to hiring senior executives from larger companies, believing their experience will automatically translate to improved operations. Mostly I see this happening prematurely. There’s a time and a place for these hires, the timing is key.

Executive success in high-growth companies often correlates more strongly with cultural fit and founder-executive alignment than with prior experience at larger organizations.

Companies that invest in creating clear executive success frameworks and integration processes typically see substantially higher executive retention and performance compared to those focused primarily on credentials and experience.

At RVNU we exist largely for this reason, to ensure the scale VP/CRO that is brought in succeeds at the very first time of asking, and that founders don’t have to churn through 2-3 execs before landing on the right candidate.

"We need to formalize everything to operate at scale"

[MISCONCEPTION]

Many growing companies swing too far toward over-systematization, believing that scaling requires eliminating the flexibility and agility that enabled early success. This creates bureaucratic overhead that slows decision-making and stifles innovation without delivering proportional benefits.

The reality is that successful scaling requires selective systematization focused on areas where consistency drives value, while preserving agility in areas where flexibility provides competitive advantage.

Most folks swing too far in either direction, no systematization or over-systematization. Finding and operating in that middle ground is the holy grail at this stage of growth.

Companies that implement thoughtful, staged approaches to process development typically maintain faster decision-making while achieving better operational consistency compared to those implementing comprehensive formalization.

Again, at RVNU we pride ourselves on finding the right balance to optimize towards aggressive revenue growth.

Business Impact

The organizational capability ceiling

[IMPACT]

The failure to navigate the Enterprise Scaling Chasm creates a fundamental constraint on growth potential, limiting companies' ability to capture market opportunities even when product-market fit is strong. This ceiling effect becomes increasingly problematic as market opportunities expand faster than organizational capabilities.

Companies stuck in the Enterprise Scaling Chasm typically experience:

Declining customer satisfaction as service quality becomes inconsistent

Increasing operational costs as inefficiencies compound with scale

Loss of competitive advantage as more organized competitors gain market share

Difficulty attracting top talent who expect professional operational environments

Strategic opportunities missed due to execution limitations

The capital efficiency deterioration

[IMPACT]

Beyond operational constraints, organizational scaling challenges typically create significant capital efficiency problems. Without proper systems and leadership, growth becomes increasingly expensive and difficult to sustain as companies enter what feels like a hire and fire vortex.

The financial consequences are substantial:

Operating expenses grow faster than revenue as organizational inefficiencies compound

Customer acquisition and success costs increase due to operational complexity

Executive hiring costs rise as multiple attempts are needed to find the right fit

Opportunity costs increase as management attention diverts from strategic priorities

Companies that successfully navigate organizational scaling typically maintain operating leverage through growth, while those that struggle often see unit economics deteriorate even with strong top-line growth, creating funding challenges just as capital needs increase.

Key Principles to Consider

Systematic executive integration

[PRINCIPLE]

Companies that successfully cross the Enterprise Scaling Chasm develop comprehensive approaches to attracting, integrating, and enabling senior executives rather than treating hiring as a simple talent acquisition challenge. This systematic approach transforms executive success rates and organizational performance.

Effective approaches include:

Creating clear role definitions and success metrics for executive positions

Implementing structured onboarding processes that address cultural integration

Establishing regular founder-executive alignment processes

Building executive coaching and development programs

Creating clear authority frameworks that reduce role confusion

Organizations that implement systematic executive integration typically see substantially higher executive retention and faster time-to-productivity compared to those taking ad-hoc approaches to senior hiring.

Selective process systematization

[PRINCIPLE]

Successful companies approach process development strategically, focusing systematization efforts on areas where consistency drives disproportionate value while preserving flexibility in areas where agility provides competitive advantage.

Effective systematization includes:

Identifying critical processes where variation creates significant customer or operational impact

Implementing staged approaches that build complexity gradually

Creating feedback loops to continuously optimize processes

Balancing documentation with training to ensure process adoption

Maintaining regular review cycles to prevent bureaucratic drift

Companies that implement selective systematization typically achieve significantly better operational consistency while maintaining decision-making speed comparable to their pre-scaling performance.

Strategic expansion discipline

[PRINCIPLE]

Crossing the Enterprise Scaling Chasm requires developing sophisticated approaches to evaluating and pursuing expansion opportunities that complement rather than compete with core business operations.

Effective expansion discipline includes:

Creating clear criteria for evaluating new market opportunities

Implementing resource allocation frameworks that protect core business performance

Establishing success metrics and review processes for expansion initiatives

Building organizational capabilities that support multiple business lines

Developing integration strategies that leverage rather than duplicate existing strengths

Organizations that maintain strategic expansion discipline typically achieve substantially higher success rates in new market penetration while maintaining stronger core business performance compared to those pursuing opportunistic expansion approaches.

Diagnostic Questions

Are key operational decisions bottlenecked by founder involvement?

WHY IMPORTANT: Reveals organizational dependency constraints

INDICATOR: Frequent founder escalation suggests insufficient delegation and systematization

Do you struggle to maintain consistent quality as teams expand?

WHY IMPORTANT: Tests process systematization adequacy

INDICATOR: Quality variance indicates inadequate operational frameworks

Have you successfully integrated senior executives without cultural disruption?

WHY IMPORTANT: Measures executive integration capability

INDICATOR: Integration challenges suggest organizational readiness gaps

What percentage of your critical knowledge exists only in key individuals' heads?

WHY IMPORTANT: Reveals knowledge management maturity

INDICATOR: High individual dependency creates scaling risks

Are expansion initiatives strengthening or diluting your core business performance?

WHY IMPORTANT: Tests strategic expansion discipline

INDICATOR: Core business decline during expansion suggests focus and resource challenges

Market Observations

The rise of systematic organizational development

[TREND]

The B2B SaaS landscape has seen growing recognition that organizational scaling requires as much attention and investment as product development. This shift reflects increasing understanding that operational excellence becomes a key competitive differentiator as markets mature.

This evolution has manifested in several ways:

Growing investment in organizational development and executive coaching

Emergence of specialized roles focused on operational excellence and process optimization

Increased emphasis on cultural development and values-based hiring

Evolution of management methodologies specifically designed for high-growth companies

Growing importance of organizational metrics alongside financial performance indicators

This trend creates both challenges and opportunities. Companies that invest systematically in organizational development gain significant competitive advantages, while those maintaining startup operations indefinitely increasingly struggle to compete with more professionally managed competitors.

Organizational scaling benchmarks by growth stage

[BENCHMARK]

While organizational development varies significantly by company culture and market dynamics, clear benchmarks exist for what constitutes effective scaling at different revenue levels. Based on observations from successful SaaS companies:

$10-15M ARR: Typically requires 1-2 senior executives and basic process documentation

$15-25M ARR: Usually needs 3-5 senior executives and systematic process management

$25M+ ARR: Generally requires full executive team and comprehensive operational frameworks

Companies that align their organizational development with these benchmarks typically achieve better growth efficiency and executive retention compared to those either under-investing or over-investing in organizational complexity relative to their scale.

The most successful companies anticipate organizational needs 6-12 months before reaching the revenue levels that typically require them, allowing for smoother transitions and maintained growth momentum.

Considerations by Company Stage

For Early Scaling Focus ($10-15M ARR)

Companies approaching the Enterprise Scaling Chasm should focus on establishing foundational scaling capabilities:

Beginning systematic documentation of critical processes and decision frameworks

Developing clear criteria and processes for senior executive hiring

Creating basic organizational metrics and performance management approaches

Establishing cultural development programs that can scale with growth

Implementing initial approaches to knowledge management and transfer

For Advanced Scaling Focus ($15M+ ARR)

Companies already experiencing organizational scaling challenges should prioritize:

Implementing comprehensive executive integration and development programs

Developing sophisticated process management approaches that balance consistency with agility

Creating advanced organizational metrics and continuous improvement methodologies

Building comprehensive leadership development and succession planning

Establishing systematic approaches to strategic expansion and resource allocation

Common Questions

How do we know when we need senior executives?

The optimal timing depends less on specific revenue thresholds and more on organizational complexity and founder capacity. Key indicators include founders spending majority time on operational issues rather than strategic priorities, consistent execution challenges across teams, and difficulty maintaining quality standards as teams expand. Most companies begin serious executive hiring as they approach $10-15M ARR, but the specific timing depends on growth rate, team size, and operational complexity. The key is anticipating needs before they become crisis points.

How do we maintain startup culture while adding structure?

Successful culture preservation during scaling requires intentional culture definition and systematic reinforcement rather than hoping informal approaches will persist. The most effective companies explicitly define their cultural values and create systematic approaches to hiring, onboarding, and performance management that reinforce these values. Structure should enhance rather than replace cultural elements, focusing on areas where consistency drives value while preserving flexibility in areas where culture provides competitive advantage.

Should we systematize everything or maintain flexibility?

The optimal approach involves selective systematization focused on areas where consistency drives disproportionate value.

Customer-facing processes, financial controls, and safety-critical operations typically benefit from systematic approaches, while innovation, problem-solving, and strategic decision-making often benefit from maintained flexibility.

The most successful companies regularly review their process portfolio to ensure systematization efforts focus on highest-impact areas while preserving agility where it provides competitive advantage.

Next Step: Get Your Personalized Growth Plan

Before investing significant resources into addressing organizational scaling challenges, it's crucial to understand exactly where your company stands across all 16 stages of B2B SaaS growth.

The Enterprise Scaling Chasm may be your primary obstacle, or it could be one of several interconnected challenges affecting your growth trajectory.

The $20M Roadmap provides a comprehensive assessment of your company's current state across all critical growth dimensions. By completing this assessment, you'll receive a personalized growth plan that:

Identifies your specific organizational scaling obstacles with precision

Places these challenges in the context of your overall GTM maturity

Provides a prioritized action plan based on your unique situation

Highlights the highest-impact opportunities for immediate improvement

Creates a clear roadmap for sustainable, predictable growth

Understanding your company's specific growth challenges is the essential first step to implementing effective solutions.

Rather than applying generic best practices, the $20M Roadmap helps you focus your time, capital, and team resources on the exact areas that will drive the greatest impact for your business.

Complete your $20M Roadmap assessment today

Onwards,

Wayne

Founder & CEO, RVNU

Related Topics

Previous Challenge Area: Retention & Expansion Chasm

Related Problem Spaces: Pipeline Scaling Chasm

About RVNU

RVNU provides B2B SaaS founders with the commercial expertise needed to build sustainable growth engines. Our insights and frameworks are grounded in real-world experience from two key sources:

Our team's combined 40+ years in B2B SaaS revenue leadership roles, spanning the entire company lifecycle from pre-seed to IPO

Deep dive engagements with over 100 B2B SaaS founders over the past 3+ years, where we've served as advisors, fractional operators and investors helping solve their most challenging go-to-market problems

Our 16-stage framework helps companies navigate the entire journey from initial product validation to scaled commercial operations, with a particular focus on the critical transitions that determine long-term success.

The $20M Roadmap identifies exactly where your company stands across these 16 stages and provides prioritized guidance on addressing your specific GTM challenges. Learn more about the $20M Roadmap here.