RVNU #023: Pipeline Scaling Chasm

How to sustain predictable up-to-the-right revenue growth after hiring rep #3

IMPORTANT NOTE: The RVNU newsletter is intended to be your unofficial B2B SaaS Startup MBA, with a focus on all things go-to-market.

This is the final free in-depth article of The RVNU Newsletter. From June 1st we will endeavor to publish 2 free short form articles per month, plus 2 deep dives on the framework and RVNU Operating System for fully paid subscribers - plus extras, such as special guest posts and bonus free frameworks throughout the year, and some virtual community events.

For those subscribing before May 31st 2025 you will receive a 50% discount forever, and pay $99.50 per year (vs full price $199 per year).

Click here to subscribe

[STAGE: 9-11]

[PROBLEM: Unpredictable Pipeline Generation]

[FOR: Technical Founders/B2B SaaS Companies]

[TOPIC: Revenue Scaling Challenges]

Introduction

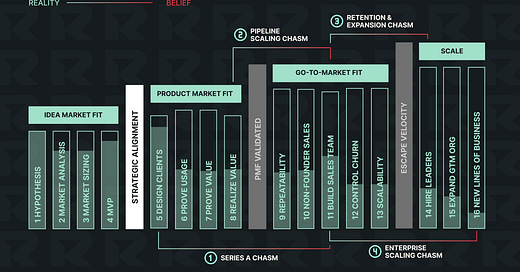

When I thought I’d cracked scaling revenue in my first revenue leadership role at a startup back in 2010, I quickly realized that getting beyond 2-3 reps selling consistently was super challenging. I then started speaking with other CEOs, General Managers, Chief Revenue Officers and VPs of Sales, and to my surprise they all experienced something similar around the $3-5M/3-5 rep stage… …that 3rd/4th rep was much harder to ramp effectively than the first batch of reps.

This presented an existential threat to our jobs and our startups. So it’s been a full 15 years that I’ve been studying this phenomenon with them. Today’s newsletter are some hot takes from the trenches about what me, Laura (my co-founder at RVNU) and my revenue leader colleagues across the SaaS ecosystem uncovered, and what that taught us about how to traverse the “Pipeline Scaling Chasm”

Enjoy! 👊🏼

The Challenge

As B2B SaaS companies reach $3-8M ARR and begin building their commercial teams, many founders encounter a perplexing obstacle: despite having successfully transitioned from founder-led sales to a small team, revenue growth suddenly becomes inconsistent and unpredictable. Our research has identified that 62% of B2B SaaS companies struggle with predictable revenue generation even after establishing initial sales success. This challenge—the Pipeline Scaling Chasm—emerges when companies attempt to scale beyond a handful of sales representatives and need to generate consistent pipeline across multiple channels. Without addressing this challenge, companies find themselves trapped in a cycle of missed forecasts, unpredictable performance, and deteriorating investor confidence.

Problem Exploration

The Multi-Channel Complexity

[PROBLEM_ASPECT: Difficulty scaling beyond initial successful channels]

Early-stage companies typically find growth through one or two effective channels—often outbound sales or direct founder networks. The Pipeline Scaling Chasm emerges when these initial channels reach saturation, requiring companies to develop multi-channel approaches without the expertise or infrastructure to manage them effectively.

This challenge manifests in several ways:

New channels produce inconsistent results compared to proven approaches

Resources spread too thinly across too many potential channels

Channel performance metrics vary widely without clear correlation to inputs

Early success in new channels proves difficult to scale

Competing internal priorities create confusion about channel investment

The Sales Efficiency Deterioration

[PROBLEM_ASPECT: Declining performance metrics as team grows]

As sales teams expand beyond the initial high-performers, companies often face a troubling pattern of deteriorating efficiency metrics. What worked for the first few representatives fails to translate to a larger organization, creating significant variance in performance.

Key symptoms include:

Wide disparities in performance between top and bottom performers (often 5-10x)

Steadily increasing customer acquisition costs, often due to more (inefficient) human touches

Longer sales cycles for new team members

Decreasing win rates despite similar prospect characteristics

Growing frustration among sales leadership about predictability

David Skok, General Partner at Matrix Partners notes:

“As you add complexity to your sale, you need to add more human touch into the sale. Adding human touch is unbelievably expensive and pushes your CAC upwards dramatically.” - via SaaStr

The Marketing-Sales Alignment Gap

[PROBLEM_ASPECT: Disconnects between demand generation and sales execution]

As companies scale, marketing typically assumes greater responsibility for pipeline generation. However, without proper alignment, this transition often creates friction rather than acceleration, with both teams frustrated by the quantity and quality of leads.

Common manifestations include:

Marketing generating leads that sales considers unqualified

Sales ignoring or inadequately following up on marketing-generated leads

Disagreement about ideal customer profile characteristics

Misaligned metrics and incentives between teams

Lack of feedback loops to improve targeting and messaging

In my opinion, the easiest and frankly most elegant way to solve this is to hire marketing leaders who are prepared to be on the hook for revenue. It blows my mind how many marketing leaders today, don’t want to connect their work to the output of the sales team. Run a mile from those types of marketers!

Common Misconceptions

"We need more leads at the top of the funnel"

[MISCONCEPTION]

When pipeline becomes unpredictable, many companies default to a volume-focused approach, investing heavily in generating more leads without addressing qualification or conversion challenges. This creates a "leaky bucket" problem where additional volume merely amplifies inefficiencies rather than driving growth.

The reality is that pipeline quality typically matters more than quantity at this stage. Research from Demandbase shows that companies with the most efficient growth focus on improving conversion rates through better qualification and sales process optimization before dramatically scaling lead volume. Companies that prematurely focus on volume often see their CAC increase by 30-50% while conversion rates decline, creating a dangerous spiral of inefficiency.

"Our AEs should be prospecting for themselves"

[MISCONCEPTION]

Many companies try to solve pipeline challenges by requiring Account Executives to generate their own pipeline, believing this creates accountability and ensures quality. Whilst outbound is a critical piece of the mix, and should remain as part of the marketing mix for every enterprise B2B rep in perpetuity, this approach usually fails to scale as an isolated strategy, as developing a top of funnel flywheel and closing deals simultaneously eventually becomes impossible to sustain consistently. And consistency is the goal.

The reality is that most high-performing B2B SaaS companies deliberately separate prospecting from closing as they scale. Role specialization should really just be a sales velocity math question.

What Ideally Happens When You Add an SDR?

Let’s look at a before-and-after example.

🚫 Before SDR Support:

Opportunities: 5 per month

Average Deal Size: $80,000

Win Rate: 15%

Sales Cycle: 6 months (180 days)

✅ After Adding a Dedicated SDR:

Your SDR improves prospecting, qualifies better-fit leads, and lets AEs focus on closing. The result:

Opportunities: 10 per month (+100%)

Average Deal Size: $80,000 (no change)

Win Rate: 20% (+5 points)

Sales Cycle: 4 months/120 days (2 months faster)

That’s a 4x increase in sales velocity—without changing pricing, or product. Of course it also increases the CAC, but it’s easily offset by the improvement in closed ARR.

Note: you tend to see the average deal size climb too, as enterprise B2B SaaS firms cement their maturity in the GTM fit stage of growth, which further improves sales velocity. I obsess about this as a revenue leader today, paying special attention to the potential of the expansion value.

Business Impact

Inconsistent growth and missed forecasts

[IMPACT]

The most immediate consequence of the Pipeline Scaling Chasm is erratic, unpredictable growth. Companies find themselves alternating between strong months and disappointing ones, creating a "feast or famine" pattern that makes forecasting nearly impossible and erodes investor confidence.

This unpredictability directly impacts strategic decisions around hiring, cash management, and fundraising. With unreliable forecasts, companies either under-invest in growth (missing opportunities) or over-invest (creating unsustainable burn rates). Either mistake can be existential for companies at this stage.

The longer-term impact is equally problematic. Companies stuck in the Pipeline Scaling Chasm typically see their growth rates decline over time, as inconsistent pipeline makes it increasingly difficult to maintain momentum.

At RVNU we have often referred to the specific stage between product market fit and go-to-market fit as the “efficient growth chasm”, which is born in product market fit, but certainly has a major impact on a startups ability to scale pipeline if gaps in the PMF stage of growth are ignored.

Rising acquisition costs and deteriorating unit economics

[IMPACT]

Beyond unpredictable growth, the Pipeline Scaling Chasm often triggers a concerning deterioration in unit economics. As companies struggle to generate consistent pipeline, they typically increase sales and marketing spend, hoping that additional resources will solve the problem.

Without addressing the underlying challenges, this additional investment yields diminishing returns:

Customer acquisition costs increase 50-100% without corresponding increases in customer lifetime value

Payback periods extend from 12-18 months to 24-36+ months

Sales and marketing expense as a percentage of revenue climbs from 30-40% to 50-70%

Return on marketing investment declines by 30-50%

For venture-backed companies, this deterioration makes raising the next round significantly more difficult. For bootstrapped companies, it can quickly transform profitable growth into unsustainable losses.

Key Principles to Consider

Multi-channel orchestration

[PRINCIPLE]

Successfully navigating the Pipeline Scaling Chasm requires thinking in terms of orchestration rather than individual channel optimization. Companies that cross this chasm develop systematic approaches to testing, measuring, and scaling multiple channels in coordination.

Effective approaches include:

Implementing consistent measurement frameworks across all channels

Creating clear testing methodologies to quickly validate new channels

Developing channel-specific playbooks based on proven approaches

Establishing clear ownership and accountability for each channel

Building feedback loops to continuously optimize channel performance

In our experience at RVNU, companies that implement effective multi-channel orchestration achieve more predictable pipeline generation compared to those that manage channels in isolation.

A good example is leveraging marketing and product driven webinars to invigorate prospects at the early to mid stage in the sales funnel. This can have a dramatic impact on sales velocity. Even better is combining these webinars with the distribution efforts of channel partners such as 3rd party SIs (system integrators) that my friend Filip Kaliszan executed so well at Verkada. Also, partnering with clients to deliver the content via these webinars as prospects move from ‘problem unaware’ to ‘solution aware’ in their buying maturity is also very powerful.

Specialized role definition

[PRINCIPLE]

As companies scale beyond initial success, role specialization becomes increasingly critical for maintaining efficiency. Rather than having generalists handle the entire sales process, high-performing organizations create specialized roles aligned with the distinct skills required at each stage.

Effective specialization includes:

Separating prospecting (SDR/BDR) from deal closing (AE) responsibilities

Creating distinct inbound and outbound prospecting approaches

Developing specialized enablement for each role

Implementing appropriate compensation structures for different functions

Building clear handoff processes between specialized roles

Verkada evolved their original SDR program into an MDR program deliver 4x the ROI that their previous SDR program was delivering. Each MDR can book about 120 meetings per month, versus 30 for the SDR!

Verkada do a nice breakdown of this program on their blog. Check it out here.

Metrics-driven pipeline management

[PRINCIPLE]

Predictable revenue requires transitioning from intuitive to systematic pipeline management. Companies that successfully cross the Pipeline Scaling Chasm implement robust measurement systems that provide early visibility into potential challenges.

Effective approaches include:

Tracking leading indicators (activity metrics) rather than just outcomes

Creating consistent pipeline inspection processes

Implementing stage-based conversion metrics with benchmarks

Developing realistic forecasting methodologies based on historical data

Building early warning systems for pipeline health

This is where RevOps is critical, and so often overlooked. More on this topic here.

Diagnostic Questions

Do your conversion rates vary widely between sales team members?

WHY IMPORTANT: Reveals process and enablement gaps

INDICATOR: High variance suggests lack of systematic sales approaches/inconsistent hiring

Can you accurately forecast revenue 90+ days in advance?

WHY IMPORTANT: Tests pipeline visibility and management

INDICATOR: Poor forecasting accuracy indicates insufficient pipeline process/lack of investment in RevOps

Has your customer acquisition cost increased significantly as you've scaled?

WHY IMPORTANT: Reveals efficiency challenges

INDICATOR: Rising CAC suggests diminishing returns on current approaches

Do marketing and sales disagree about lead quality and follow-up?

WHY IMPORTANT: Exposes alignment problems

INDICATOR: Frequent disagreements indicate broken handoff processes/target alignment

Does your pipeline generation depend heavily on a few top performers?

WHY IMPORTANT: Tests organizational dependency risks

INDICATOR: Over-reliance on individuals suggests lack of systematic approaches

Market Observations

The rise of specialized GTM tech stacks

[TREND]

The B2B SaaS landscape has seen explosive growth in specialized tools designed to address pipeline challenges. From conversation intelligence platforms to intent data providers, companies now have access to technologies that weren't available to previous generations of SaaS businesses.

While these tools offer significant potential, they also create complexity. Most successful companies at the Pipeline Scaling stage develop thoughtful approaches to technology adoption, focusing on solving specific pipeline challenges rather than chasing the latest trends.

This technology evolution has simultaneously raised the bar for what constitutes effective pipeline generation and created new opportunities for companies willing to invest in the right tools and processes. Companies that successfully leverage these technologies can create significant competitive advantages in pipeline generation efficiency.

At RVNU we use tools such as: Hubspot, Starbridge, Apollo, Sybill amongst a number of others to optimize the flow and analysis of highly qualified leads.

Considerations by Company Stage

For Early Pipeline Scaling ($3-5M ARR)

Companies entering the Pipeline Scaling Chasm should focus on establishing fundamental systems:

Implementing clear activity and outcome metrics for all pipeline generation activities

Developing specialized roles with distinct responsibilities and success measures

Creating consistent qualification frameworks to ensure pipeline quality

Establishing regular pipeline review processes with forward-looking indicators

Building feedback loops between marketing and sales to continuously improve targeting

For Advanced Pipeline Scaling ($5-8M+ ARR)

Companies already experiencing pipeline scaling challenges should prioritize:

Conducting comprehensive funnel analysis to identify specific conversion challenges

Implementing specialized enablement for different sales roles

Developing systematic approaches to territory and account planning

Creating advanced forecasting methodologies based on historical conversion data

Building capacity planning models to align hiring with pipeline generation needs

Common Questions

When should we specialize our sales roles into SDR/AE functions?

This transition typically makes sense as you approach $3-5M ARR or when you have more than 3-5 quota-carrying representatives. The key indicator isn't revenue alone, but rather when you notice your best closers spending too much time prospecting or when prospecting quality becomes inconsistent. Companies that delay specialization too long often see their best AEs underperform as they're forced to split time between closing and prospecting.

Should we invest more in marketing or sales to solve pipeline challenges?

Rather than thinking about marketing vs. sales investment, consider the specific pipeline gaps you're experiencing. If your challenge is primarily top-of-funnel awareness and interest generation, marketing investments may yield better returns. If you're generating sufficient interest but struggling with qualification or conversion, sales investments might be more appropriate. The most successful companies align investments precisely to their specific pipeline bottlenecks rather than making generic resource allocation decisions.

How do we balance pipeline quality and quantity?

This balance typically evolves as companies scale. In early stages, quality usually matters more than quantity, as limited sales capacity means each opportunity must have high conversion potential. As you scale, maintaining strict quality standards while increasing volume becomes the central challenge. The most effective approach is to implement tiered qualification frameworks that route higher-quality opportunities to appropriate resources while still capturing and nurturing lower-quality opportunities that may convert over time.

Next Step: Get Your Personalized Growth Plan

Before investing significant resources into addressing pipeline challenges, it's crucial to understand exactly where your company stands across all 16 stages of B2B SaaS growth. The Pipeline Scaling Chasm may be your primary obstacle, or it could be one of several interconnected challenges affecting your growth trajectory.

The $20M Roadmap provides a comprehensive assessment of your company's current state across all critical growth dimensions. By completing this assessment, you'll receive a personalized growth plan that:

Identifies your specific pipeline generation obstacles with precision

Places these challenges in the context of your overall GTM maturity

Provides a prioritized action plan based on your unique situation

Highlights the highest-impact opportunities for immediate improvement

Creates a clear roadmap for sustainable, predictable growth

Understanding your company's specific growth challenges is the essential first step to implementing effective solutions. Rather than applying generic best practices, the $20M Roadmap helps you focus your time, capital, and team resources on the exact areas that will drive the greatest impact for your business.

Complete your $20M Roadmap assessment today

Onwards,

Wayne

Founder & CEO, RVNU

Related Topics

Previous Challenge Area: Series A Chasm

Next Challenge Area: Retention & Expansion

Related Problem Spaces: Early Stage SaaS Metrics

About RVNU

RVNU provides B2B SaaS founders with the commercial expertise needed to build sustainable growth engines. Our insights and frameworks are grounded in real-world experience from two key sources:

Our team's combined 40+ years in B2B SaaS revenue leadership roles, spanning the entire company lifecycle from pre-seed to IPO

Deep dive engagements with over 100 B2B SaaS founders over the past 3+ years, where we've served as advisors, fractional operators and investors helping solve their most challenging go-to-market problems

Our 16-stage framework helps companies navigate the entire journey from initial product validation to scaled commercial operations, with a particular focus on the critical transitions that determine long-term success.

The $20M Roadmap identifies exactly where your company stands across these 16 stages and provides prioritized guidance on addressing your specific GTM challenges. Learn more about the $20M Roadmap here.