RVNU #036: Startup MBA - Lecture 3

Market Sizing

[STAGE: 3. Market Sizing]

[PROBLEM: Building for Small Outcomes and Losing Conviction Under Pressure] [FOR: B2B SaaS Founders]

[TOPIC: TAM, SAM, SOM Quantification and Opportunity Sizing]

Market Sizing: Beyond the Theater of Big Numbers

Dear RVNU SaaS Startup MBA student!

Welcome to lecture 3 of 16, where we dive deep into one of the most misunderstood yet critical aspects of building venture-scale companies: market sizing.

Glossary of Key Terms

Before we explore the challenges and solutions around market sizing, let's establish a common vocabulary:

TAM (Total Addressable Market): The total market demand for a product or service, representing the maximum revenue opportunity if you achieved 100% market share across all potential customers globally.

SAM (Serviceable Available Market): The portion of TAM that your product or service can realistically address, considering geographic limitations, regulatory constraints, and your business model's natural boundaries.

SOM (Serviceable Obtainable Market): The portion of SAM that you can realistically capture given your resources, competition, market dynamics, and execution capabilities over a specific timeframe.

B2B SaaS: Business-to-Business Software as a Service, referring to cloud-based software solutions sold to other businesses rather than individual consumers.

Series A/B: Funding rounds in venture capital, where Series A typically represents the first major institutional funding round, followed by Series B for companies demonstrating product-market fit and scaling revenue.

A Personal Perspective on Market Sizing Reality

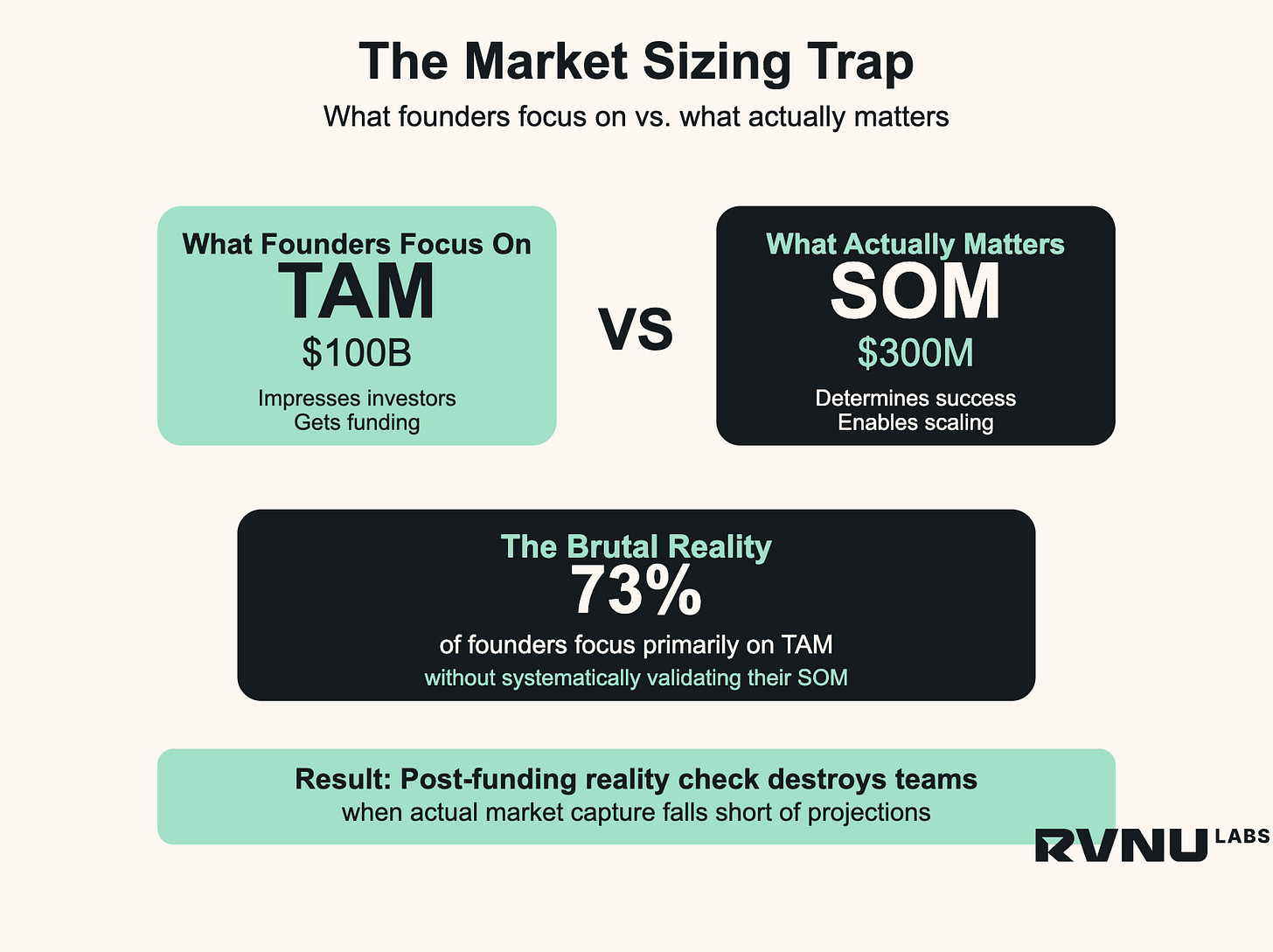

In my experience working with 100+ B2B SaaS companies, I've seen everything from completely fabricated market sizing to overly conservative estimates that undervalue genuine opportunities. However, it's fair to say that over-inflated TAMs remain the default for most founders.

The challenge isn't that founders are intentionally deceptive (in the main!)—it's that

the incentive structures around fundraising encourage TAM theater while the real work of building companies depends on honest SAM and SOM analysis. This disconnect creates a dangerous foundation that often emerges as a crisis 12-18 months post-funding.

What follows is a systematic exploration of why market sizing matters beyond investor presentations, how intellectual dishonesty about serviceable markets undermines company building, and practical frameworks for developing the market conviction needed to sustain exceptional teams through the inevitable challenges of startup growth.

This newsletter is designed for B2B SaaS founders who want to move beyond performative market analysis toward systematic opportunity validation that can support venture-scale outcomes.

Lecture 3 -Market Sizing: The Challenge

As a founder, you've probably rolled your eyes at the mention of TAM, SAM, and SOM calculations. Most founders approach market sizing as performative theater—a checkbox exercise designed to satisfy investors with impressive-sounding numbers that everyone knows are largely fictional. But here's the brutal reality: market sizing is

Keep reading with a 7-day free trial

Subscribe to The RVNU Newsletter to keep reading this post and get 7 days of free access to the full post archives.