[STAGE: Prove Value]

[PROBLEM: Design partners cannot justify your pricing, revealing ICP misalignment][FOR: Founders in B2B SaaS]

[TOPIC: Product Market Fit Validation]

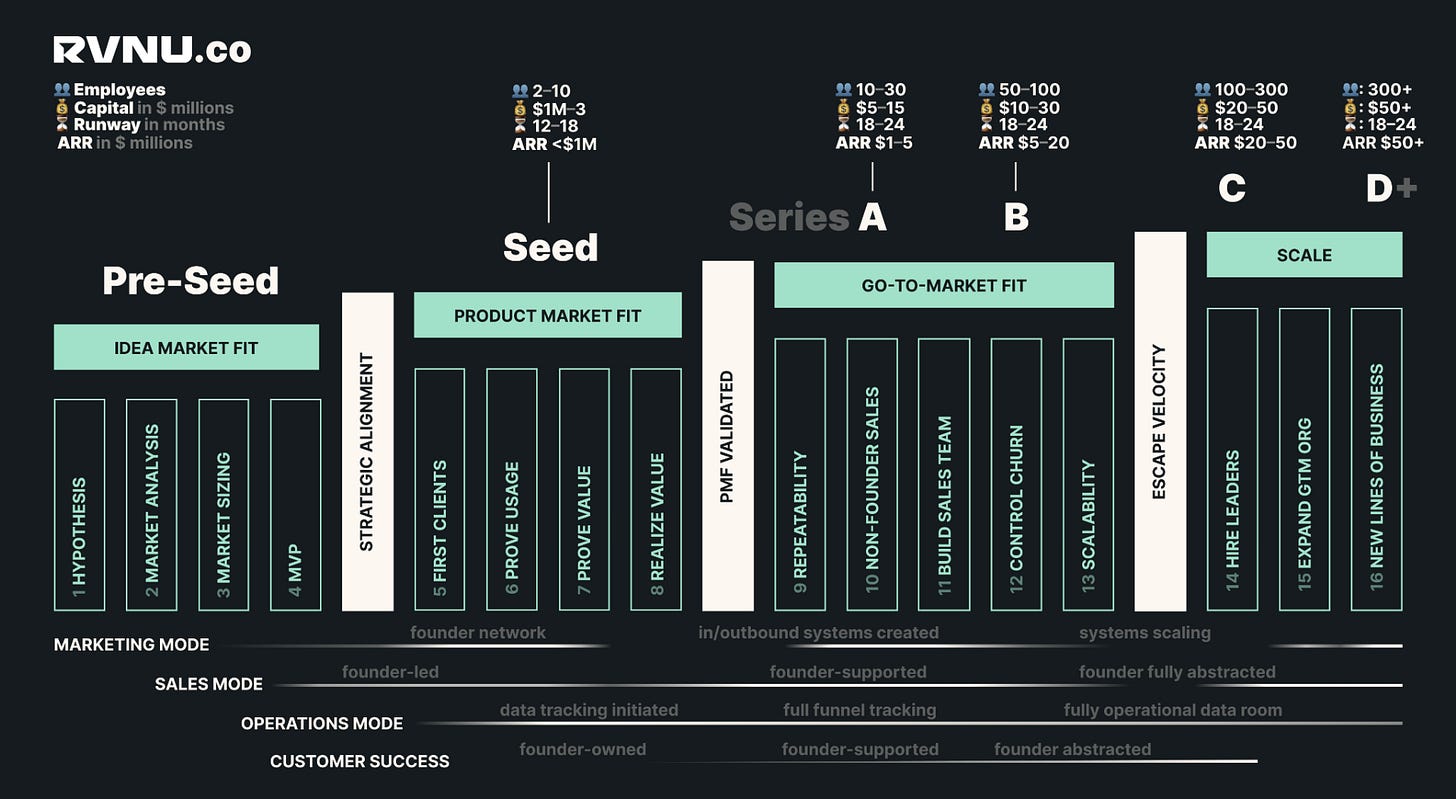

The 16-Stage RVNU Framework

Idea Market Fit

1. Hypothesis → 2. Market Analysis → 3. Market Sizing → 4. MVP

Product Market Fit

5. First Clients → 6. Prove Usage & Adoption → 7. Prove Value → 8. Realize Value

Go-to-Market Fit

9. Repeatability → 10. Non-Founder Sales → 11. Build Sales Team → 12. Control Churn → 13. Sustainability

Scale

14. Hire Executives → 15. Expand GTM Org → 16. New Lines of Business

The Challenge

You've successfully onboarded design partners who are actively using your product, but now comes the moment of truth: can they justify paying your intended price point based on measurable value?

Stage 7 of the RVNU framework represents your first real validation of the original ICP hypothesis. Some design partners will demonstrate clear value that justifies premium pricing, while others will struggle to quantify benefits that support your target economics.

The temptation is to discount pricing for struggling partners to preserve revenue, but this decision seeds long-term go-to-market debt that will constrain future growth.

The Value Validation Framework

Stage 7A: Reinforcing Investment Asset Positioning

During the sales process, you should have already positioned your solution as an investment requiring measurable returns. Now in Stage 7, you must reinforce this framing and hold design partners accountable to the value expectations established during the sales cycle. This is not about introducing new concepts but validating the value hypothesis they agreed to when signing the contract.

Investment Asset Framing

During onboarding conversations, explicitly position your solution as an investment that should generate measurable returns. Help design partners identify the specific metrics your product should impact—whether financial, operational, or mission-critical—and establish baseline measurements before full implementation.

For Financial ROI-Driven Organizations:

"What would need to change financially for this investment to pay for itself?"

"How does your organization typically calculate ROI on business tools?"

"What revenue or cost impact would justify this investment to your CFO?"

"Which financial metrics does your leadership track most closely?"

For Time/Efficiency-Focused Organizations:

Keep reading with a 7-day free trial

Subscribe to The RVNU Newsletter to keep reading this post and get 7 days of free access to the full post archives.