RVNU #033: The Zombie Unicorn Reality Check

How liquidation preferences and valuation compression are crushing employee equity dreams—and what to do about it

Psst:… Looking for the RVNU Startup MBA? 👀 Lectures are every other week right here. Sign up to the paid newsletter for access. Lecture 2 is out next Tuesday! Here’s lecture 1 in case you missed it.

NOTE: I updated this article post-publish to re-work the math. Feedback on accuracy of math always welcome. Thanks for the support there 👊🏼

The Zombie Unicorn Equity Trap: Why Your Options Are Worth Less Than You Think

They told you that 0.1% was life-changing. Let's see what that really means in 2025.

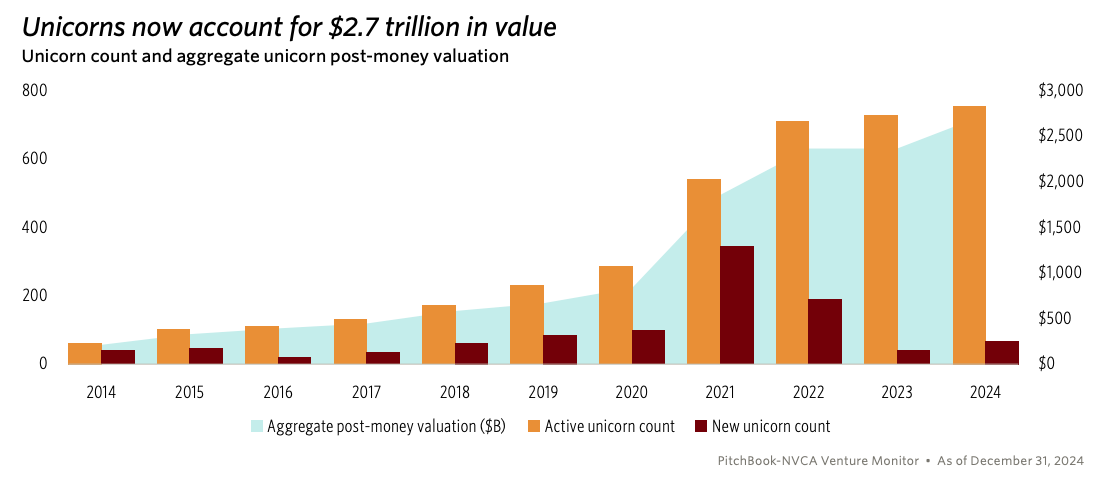

The term "unicorn" gets tossed around easily these days. Since 2021, over 1,200 companies have reportedly hit the $1B valuation mark, according to ChatGPT; PitchBook/NVCA place the number closer to 800. Regardless of the count, one thing is clear: many of those companies aren't actually creating liquidity—or wealth—for their employees.

Why? Because IPOs and M&A exits have slowed dramatically, and when exits do happen, they often fall far below peak valuations. Add investor-friendly terms like participating preferred stock, and employee equity can become close to worthless.

Let's break down how this happens—and what it means for you.

The Setup: A Typical Zombie Unicorn

Let's meet a hypothetical (but very common) example:

Total funding raised: $250M across multiple rounds

2021 peak valuation: $2B

2025 realistic exit: $800M

Capital structure: 1x participating liquidation preferences

That last one is key. It means investors get their money back plus a proportional share of the remaining value.

What Is Participating Preferred?

Before we go further, a quick primer:

Non-Participating Preferred (most common): Investors choose either their 1x investment back or convert to common equity—whichever is worth more.

Participating Preferred (investor-friendly): Investors get both their money back and their pro-rata share of the rest. This is called a "double-dip."

Distribution Math That Changes Everything

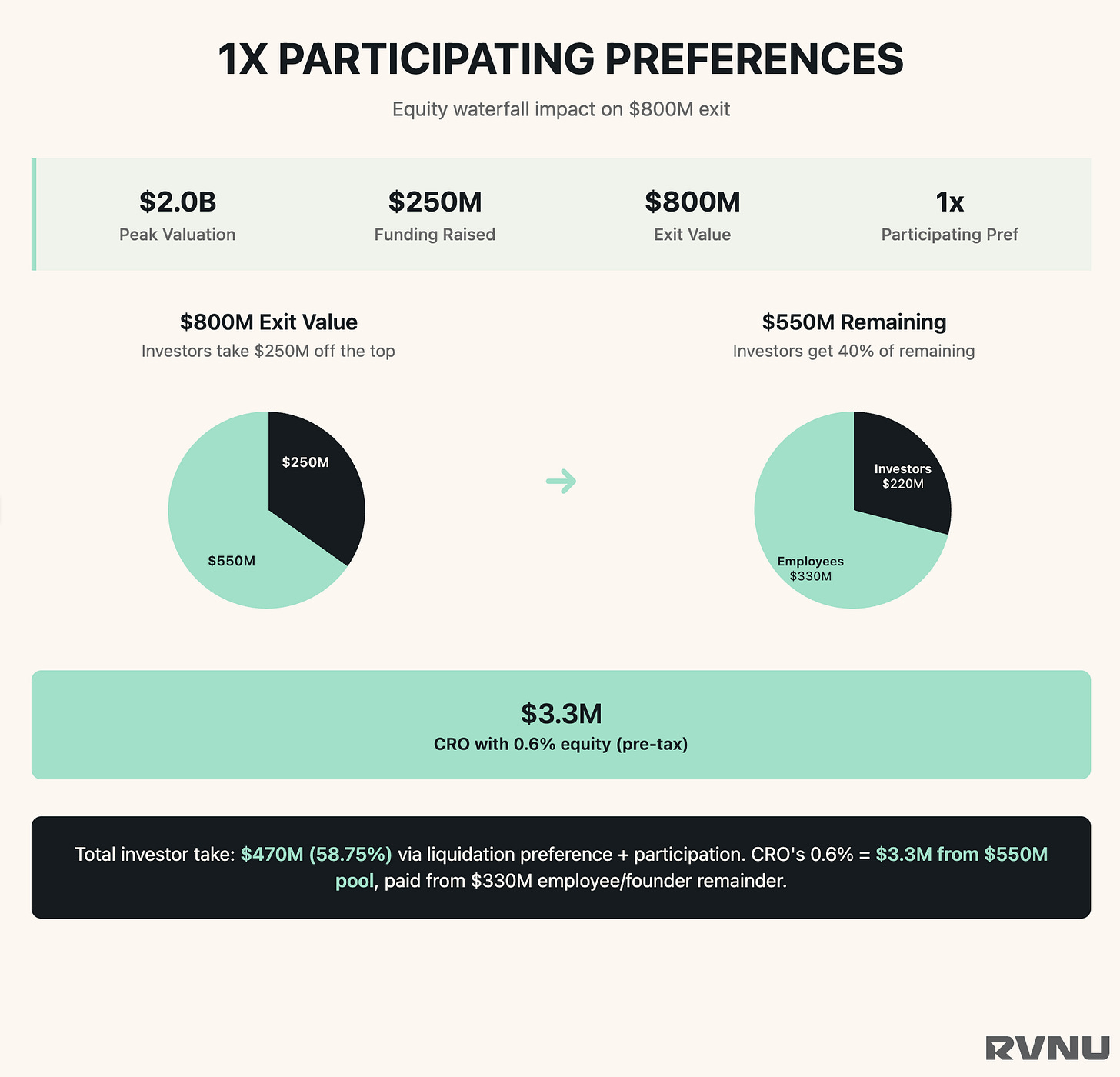

Let's assume our $800M exit plays out like this:

Step 1: Liquidation Preference First

Investors get back their $250M (1x pref) off the top

Remaining equity pool: $550M

Step 2: The "Double Dip" Happens

Investors still own 40% of the company's equity (even after getting their $250M back)

So they also get 40% of the remaining $550M = $220M more

Total to investors: $250M + $220M = $470M

Left for everyone else: $330M

Step 3: How the $330M Gets Split

Founders typically own ~20% of total company = 20% of $550M = $110M

Employee pool typically owns ~10% of total company = 10% of $550M = $55M

But remember: They're taking from the $330M leftover, not the full $550M

The Key Math:

CRO with 0.6% gets: 0.6% × $550M = $3.3M gross

But this comes from the $330M employee/founder pool

Employee pool (10% of company) gets $55M total to split among everyone

Individual employees get their percentage of the $330M remaining after investors take their double-dip

Critical Point: Your equity percentage applies to the $550M pool, but investors take both their liquidation preference AND their equity share, leaving much less actual money for employees and founders to split.

Here’s a neat visual of how 1x participating breaks down in this example:

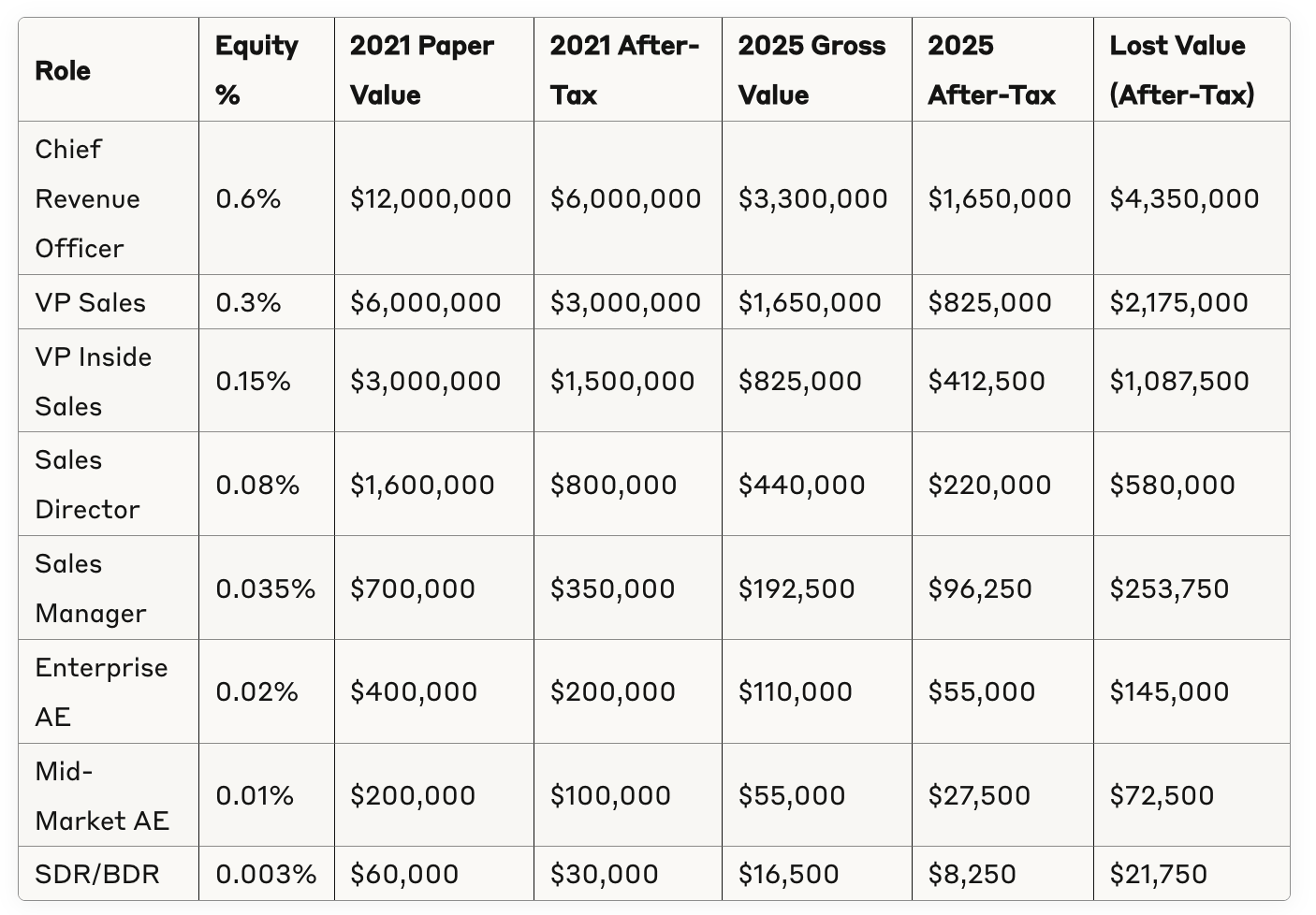

The Sales Team Equity Breakdown: 2021 vs. 2025

Let's apply this to a typical sales org. Here's what their equity looked like during the 2021 peak—and what it's actually worth in a 2025 exit scenario.

These numbers show how equity paper dreams from 2021 often turn into hard 2025 realities—especially for ICs and managers.

Strategic Framework: What You Should Do

C-Level (Meaningful Money Still Exists)

Stay put and maximize equity outcomes

Negotiate retention grants or refreshers

Use time to build acquisition relationships

Management (Tough Calls)

Evaluate total comp vs earlier-stage opportunities

Document turnaround success for your resume

Target roles with 0.1–0.5% equity in $100–500M startups

Individual Contributors (It's Time to Move)

Your equity is likely worth <$30K post-tax

Focus on cash comp and skill development

Target Series A/B companies where 0.01–0.1% equity could 10X your upside

Universal Advice: Extract Maximum Value While You Can

Skill Development

Revenue efficiency

Unit economics

Crisis management

Networking

Build relationships with acquirers and investors

Stay close to earlier-stage founders

Resume Positioning

"Led sales ops through $X in cost reductions"

"Managed team through liquidity-prep process"

The Bottom Line

Every person in this org lost 70%+ of their expected equity value since 2021—but your response should match your role:

C-Level: Stay, lead, and land the outcome

Managers: Evaluate wisely and position yourself

ICs: Get out before the next round wipes you further, or stick around and learn!

Why We Built RVNU

We help SaaS founders optimize their go-to-market engine early so their companies (and teams) don't get stuck in equity quicksand. Our GTM Debt assessment and $20M Roadmap give founders a structured path to sustainable growth, better valuations—and equity that actually pays off.

Want to know if you're sitting on zombie equity? Take the free $20M Roadmap assessment and find out.

Wayne Morris

Founder & CEO, RVNU

Source: Analysis based on Bill Gurley's zombie unicorn data from Invest Like the Best podcast, with RVNU calculations for equity distribution and California tax implications.

The RVNU Newsletter is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

Looking for the RVNU Startup MBA? Lectures are every other week. Sign up to the paid newsletter for access. Lecture 2 is out next Tuesday! Here’s lecture 1 for those that missed it.