RVNU #005: Creating a Money-Making Machine

Achieving Go-to-market Fit

AI Audio Discussion of this Newsletter:

Introduction:

My role in every startup I’ve scaled as a revenue leader was to create a money-making machine. At RVNU the phase of growth that this represents we call ”go-to-market fit”. This is also the stage when things get very serious.

The Go-to-Market Fit (GTMF) phase represents the point where your startup transitions from proving product-market fit to scaling your customer acquisition efforts. This phase is where you refine your sales processes, build your initial go-to-market team, and ensure that your business model is scalable. It’s about moving from a few early adopters to a wider market and proving that you can consistently acquire, convert, and retain customers at scale.

The Go-to-Market Fit phase is where you establish the repeatability and scalability of your sales and marketing efforts, and where you ensure that the entire customer journey—from awareness to purchase to retention—is optimized for success. At the end of this phase you have true escape velocity.

In this article, we’ll explore:

Concise definitions of the stages within the GTMF phase, including exit criteria.

Common anti-patterns that this framework prevents.

1. Repeatability

• Defintion: The first stage of Go-to-Market Fit is achieving repeatability in your sales process. This means developing a sales playbook that can be consistently executed by your team to acquire new customers. It’s about identifying the key steps in the sales process that lead to success and ensuring that these steps can be replicated by others in your organization. The founder must lead this effort.

• Wayne’s take: “When I turned up at Guidebook the founders had mapped everything. I remember listening to one of the first sellers pitch and I thought he’d pressed “play” on a tape recorder. I didn’t like the lack of dynamism but at our price point it was a numbers game and we had to have a uniform approach, and this was it, and it worked. The founders had documented everything—from how we identified leads to how we closed deals. This playbook became the foundation for building our team in Europe and allowed us to onboard new reps quickly and efficiently.”

• Exit criteria: A documented, repeatable sales process that consistently converts leads into customers. This process should be proven to work across prospects that are outside of the founder’s own network.

• Anti-patterns: Deciding that the founder being in every deal proves repeatability. We commonly see sales teams look successful, but as soon as the founder is removed from the process, everything fails.

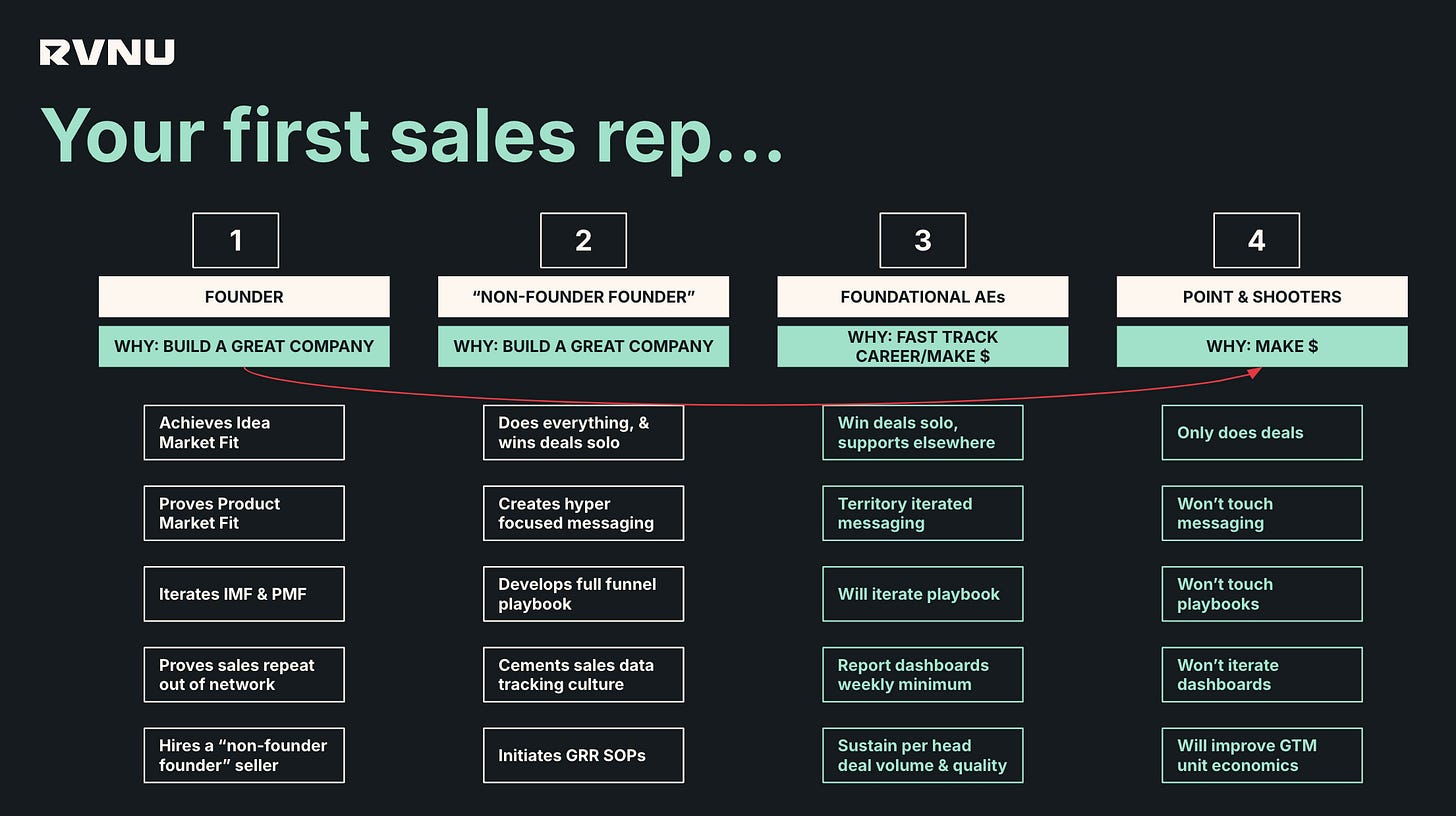

2. Hire Foundational Account Executive

• Definition: The next stage is hiring your first non-founder account executive (AE). This is a critical hire because it’s the first time someone other than the founder will be responsible for driving revenue. The right AE will not only close deals but will also help refine and improve your sales process. They’ll bring new insights and perspectives that can help you optimize your approach and scale your efforts. The type of foundational AE you hire will depend on the founder’s skill set and appetite to stay in a revenue leading capacity in the future.

• Wayne’s take: “I’ve often been this guy because there was no natural revenue leader in the firms I joined. Hired as VP but in reality I’m the first non-founder founder at the company who can own, build and run a revenue machine. I had to think and operate like a founder, it’s the only way. My motivation was only partially money. It was mostly the desire to be part of building a generational company and a huge accelerated learning opportunity. If that’s the profile you’re looking for, they’re essentially a peer to the founder vs a subordinate”

• Exit criteria: This hire should be able to operate independently and deliver results, and improve the sales process simultaneously.

• Anti-patterns: Hiring an AE too early, before your sales process is fully developed, or hiring someone who isn’t aligned with your company’s culture and vision, or hiring a “point & shooter” seller and expecting them to build process. A bad hire at this stage can set your sales efforts back significantly.

3. Build Sales Team (Role Specialize)

• Definition: Once your first “AE” is successfully closing deals, it’s time to build out your sales team. This involves hiring additional AEs and beginning to role specialize within your sales organization. Role specialization means creating dedicated roles for different parts of the sales process, such as lead generation, net new sales, and customer success. This specialization allows each team member to focus on what they do best, leading to greater efficiency and effectiveness in your sales efforts.

• Wayne’s take: “As we scaled Maxymiser, we quickly realized that role specialization was key to maintaining our growth. By having dedicated teams for lead generation, closing, and account management, we were able to operate more efficiently and scale faster. Each team member could focus on their strengths, which led to better results across the board. And interestingly, whether it was Maxymiser, Guidebook or Wonderschool we did this at break-even or better under my watch.”

• Exit criteria: A fully staffed and role-specialized sales team that is consistently hitting targets and driving revenue growth. Each team member should have a clear understanding of their role and how it contributes to the overall revenue goals of the business. All targets must be have a strong revenue related element.

• Anti-patterns: Trying to scale with a one-size-fits-all approach, where each salesperson is expected to handle every aspect of the sales process. This can lead to burnout and inefficiency, as team members are spread too thin and aren’t able to focus on their strengths.

4. Control Churn

• Definition: Churn, or customer attrition, is the rate at which customers stop using your product or service. High churn rates are a major barrier to growth, as they offset the gains made through new customer acquisition. Controlling churn involves understanding why customers are leaving and implementing strategies to retain them. There are various reasons why churn is caused, often it can be charted back to the idea market fit and product market fit phases of growth, and failures to iterate key aspects of customer acquisition with the signal received from the market, such as one’s ideal customer profile.

• Wayne’s take: “When I turned up at Maxymiser we had a major churn problem, we realized early on that acquiring customers wasn’t enough—we had to keep them. We went back to the idea market fit phase of growth and iterated ICP fast. We focused on building strong relationships with our customers, listening to their needs, and continually improving our product. The result was increased contract values, longer term contracts, and decreased churn. By controlling churn, our enterprise value sky-rocketed, and our company culture improved in line.”

• Exit criteria: A churn rate that is within industry benchmarks and does not hinder your ability to scale. You should have a clear understanding of the reasons for churn with a focus on both gross revenue retention and net revenue retention with strategies in place to optimize both.

• Anti-patterns: Ignoring churn or assuming that customer attrition is just part of doing business. In some businesses, low value or B2C with month to month contracts, high churn is a natural characteristic, but in B2B churn must be kept low. Whether B2B or B2C churn mitigation is critical for optimizing enterprise value, so it cannot be ignored, or papered over for long with net new revenue numbers.

5. Scalability

• Definition: After successfully building a repeatable process and specialized team, the final step in Go-to-Market Fit is proving that your model can scale. This means that your customer acquisition processes, sales team, and post-sale support can handle higher volumes without sacrificing efficiency or profitability.

• Wayne’s Take: “True scalability is about removing bottlenecks—whether it’s process inefficiencies, pricing issues, or sales team capacity. Before scaling, make sure your systems are watertight and ready to grow. The way I think about it is this: Can this thing scale to $100M (or whatever your SOM is) by doing what we’re doing now? If the answer is ‘no’ you have scalability issues.”

• Exit Criteria: You’ve demonstrated the ability to scale your customer acquisition and sales operations without significantly increasing your cost base. Your systems, processes, and team are optimized for scale, showing strong revenue growth with minimal bottlenecks.

• Anti-patterns: Attempting to scale prematurely without fixing foundational inefficiencies, or growing the sales team without ensuring the underlying systems can support increased demand.

Conclusion:

Achieving Go-to-Market Fit is the phase where your startup proves that it can consistently acquire, convert, and retain customers at scale. It’s where you transition from a small team of early adopters to a broader market, and where your sales and marketing efforts become repeatable and scalable.

Remember, Go-to-Market Fit is about more than just growing your customer base—it’s about ensuring that your growth is sustainable, predictable, and in some cases it makes sense to do this profitably.

Thanks for reading folks! Any questions or follow-up, drop me a note or look out for upcoming events.

Happy building! You got this 👊🏼

Wayne