RVNU #003: Creating a Hypergrowth Foundation

AI Audio Discussion of this Newsletter:

Introduction:

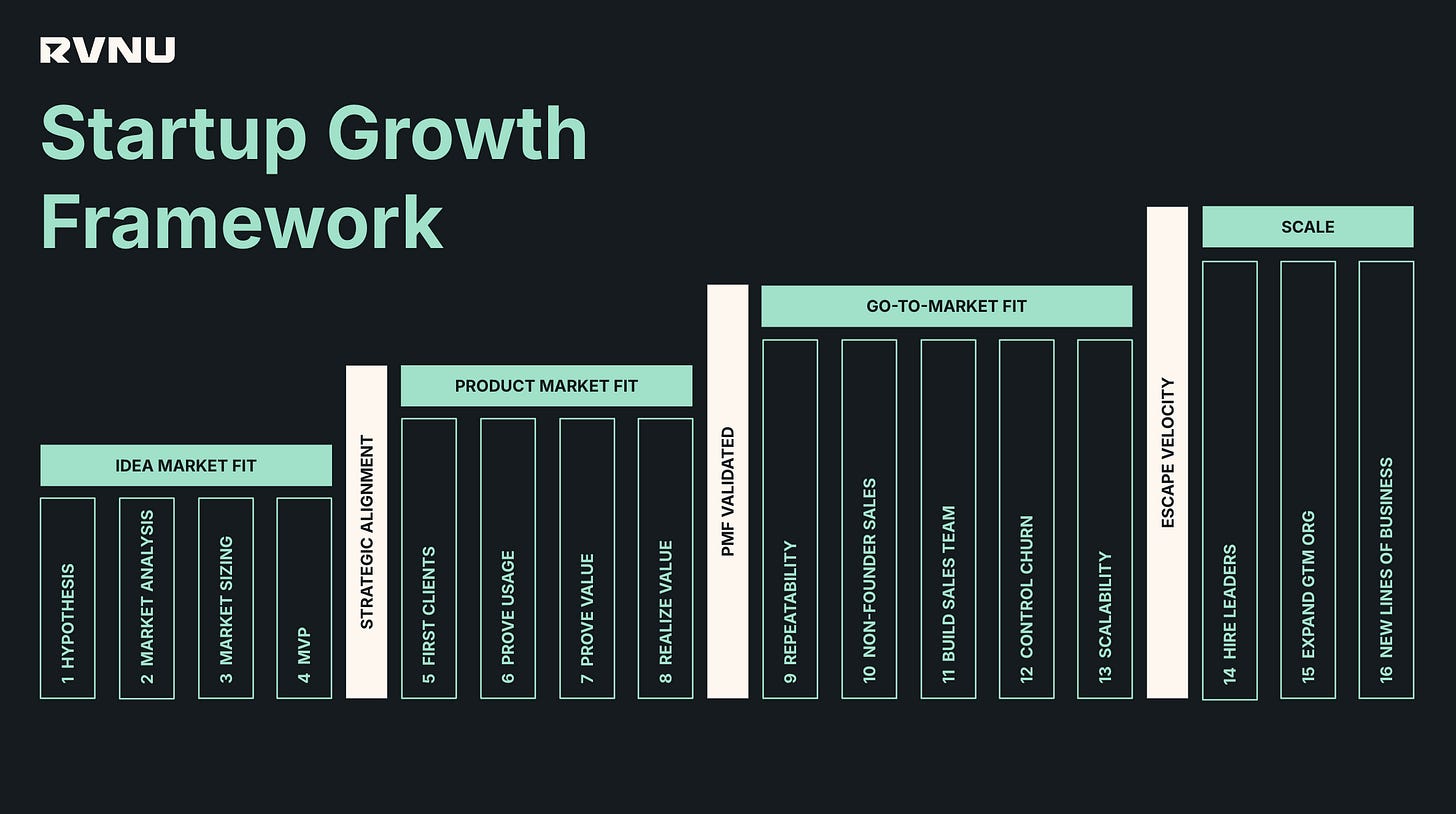

At RVNU, we define the first phase of startup growth as ‘Idea Market Fit’ (IMF). It’s a phase where the dream of a startup begins to take shape—often starting in a dorm room, during a moment of inspiration, or simply through the clarity that comes after years of working on a problem.

This is the a-ha moment, the epiphany that propels founders into action.

What follows is typically a rush of activity: building a prototype, testing it with friends, and, if successful, scaling to strangers. But for many, reality soon sets in. The enthusiasm that fueled the early days gives way to the realization that critical steps were skipped, resulting in accumulated go-to-market debt™ and the dream of hypergrowth feels a world away.

When executed optimally, the Idea Market Fit phase stress-tests, defines, and quantifies the initial epiphany. It lays the groundwork for sustainable, predictable, and repeatable revenue growth.

In this article, we’ll explore:

Concise definitions of the stages within the IMF phase, including exit criteria.

Common anti-patterns that this framework prevents.

Why key stakeholders should pay attention to this phase.

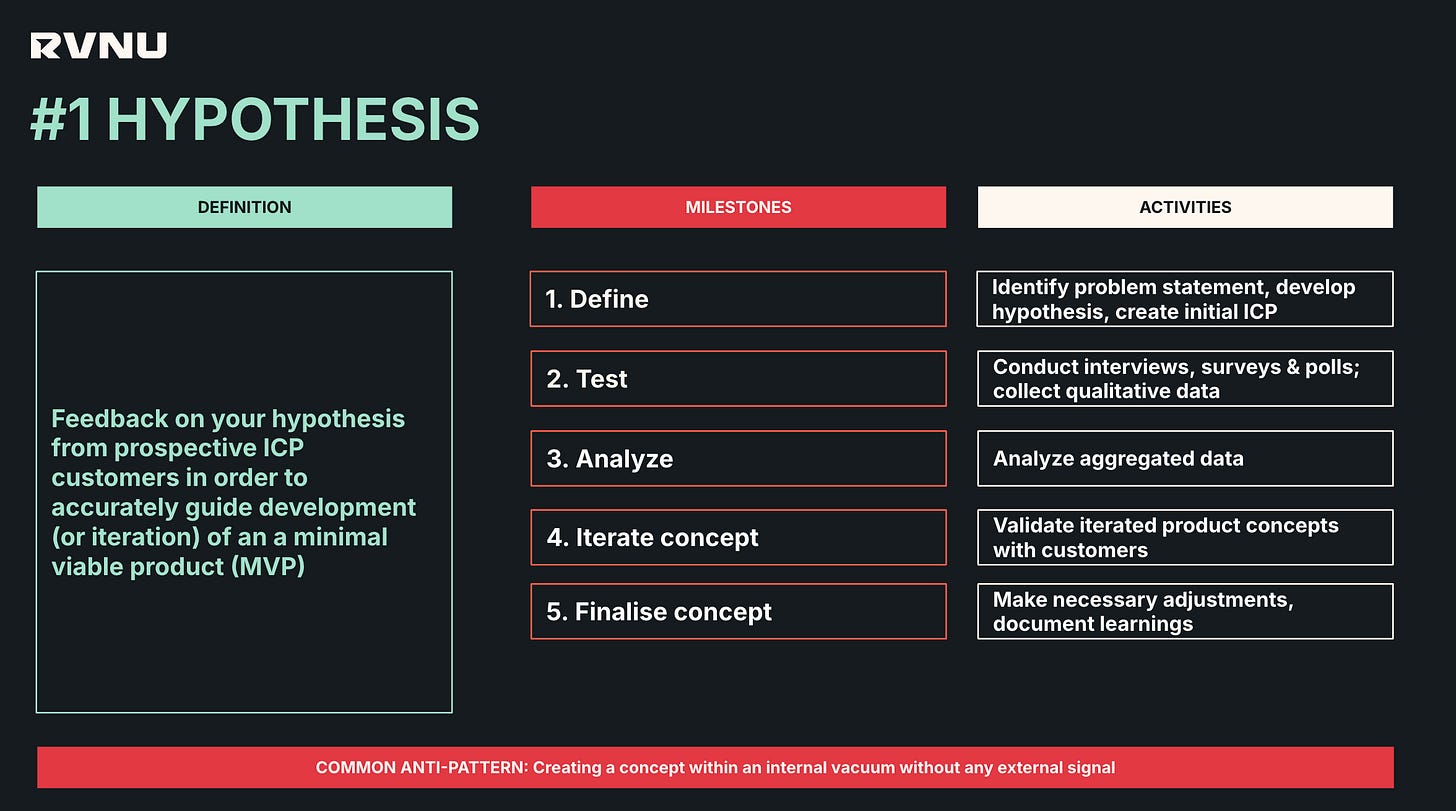

1. Hypothesis stage

• Definition: Moving beyond gut instinct, this stage is about having numerous conversations with a diverse group of people. It’s crucial to engage not just with ‘yes-people’ but with those who will challenge your ideas, particularly those who have experience in similar ventures.

• Wayne’s take: “Before I invested in Guidebook in 2014, I saw an opportunity to build a mobile content optimization platform. I knew it had potential because I had just helped a desktop-only company struggling to transition to mobile. I discussed the idea with several investors, and one in particular, Shardul Shah at Index Ventures, encouraged me to fly from London to Silicon Valley to meet with others working on similar projects. Those conversations ultimately dissuaded me from pursuing the idea, leading me instead to invest in Guidebook (who Index Ventures also had their eye on) and help build their international presence.”

• Exit criteria: Engage in many conversations with a broad spectrum of people, actively seeking reasons why your idea might not work. If, after all this, the idea still seems viable, move to the next stage of the IMF phase.

• Anti-patterns: Relying solely on your own opinion without sufficient stress-testing. While it’s important to maintain contrarian thinking, being open to challenges and feedback is essential for validating your idea.

2. Market Analysis stage

• Definition: Understanding the competitive landscape is crucial to stress-testing ones appetite to tackle the problem. At RVNU we developed a framework that encourages a scientific breakdown of the landscape. The founder needs to have even more conviction post this analysis.

From there we’d expect the founder to map out the ideal profile of company and buyer persona(s) that their idea offers the most compelling value exchange to.

If things still look good, the founder will naturally begin to develop value messaging and begin prototyping product, in their head at least!

• Wayne’s take: “I find the best founders are the ones who get presented with a long list of competitors, and reasons not to pursue something but press ahead regardless, because they believe they are coming at the problem from a different angle. A great example of that would be Tesla. Are they a car company, an energy company or a software company or all of that and more? In our case at RVNU, are we a services business, a community, a SaaS company, capital allocators or all of that and more?”

• Exit criteria: A point of view on the competitive landscape, and how you are sufficiently differentiated, with a documented definition of the target audience.

• Anti-patterns: A belief this level of research is not required. A build-it-and-they-will-come attitude.

3. Market Sizing stage

• Definition: Market sizing is about quantifying the opportunity. It’s where you move from a gut feeling that there’s a big problem to solve to knowing exactly how big that problem is—and whether it’s worth solving from a business perspective. This involves calculating the Total Addressable Market (TAM), Serviceable Available Market (SAM), and Serviceable Obtainable Market (SOM). Start with the broadest possible market that could use your solution (TAM), then narrow it down based on your specific target market (SAM), and finally, determine how much of that market you could realistically capture in the short term (SOM).

• Wayne’s take: “The value of the pain the founder originally hypothesized they are solving is the reality of the size of the market opportunity. The TAM often looks good, but the SOM commonly is what stops the company gaining traction.”

• Exit criteria: A clear, data-backed estimate of your TAM, SAM, and SOM, with a well-documented rationale for each. This should give you and your investors confidence that there’s a large enough market to justify moving forward.

• Anti-patterns: Overestimating market size by being overly optimistic or failing to validate assumptions with real data. Another common mistake is ignoring the difficulty of capturing market share, leading to unrealistic SOM projections.

4. Minimal Viable Product (MVP)

• Definition: The MVP is where your hypothesis meets the real world. It’s not about building a perfect product; it’s about building just enough to test your most critical assumptions. The MVP should be designed to gather maximum learning with the least amount of effort. This often means starting with a stripped-down version of your product that focuses on the core value proposition and putting it in front of early users as quickly as possible.

• Wayne’s take: “When we launched the first enterprise B2B SaaS version of Wonderschool , it was far from perfect. We didn’t have all the features we wanted, but we knew we had enough to start gathering feedback. That feedback loop was invaluable—it showed us what users really needed and helped us prioritize our roadmap. If we’d waited until the product was ‘finished,’ we’d have missed out on critical learning and might have built something that didn’t resonate with the market.”

• Exit criteria: A working MVP that has been tested with real users, providing actionable feedback that informs your next steps. The goal here is to validate that there’s real demand for your product and to learn what features are most critical to your users.

• Anti-patterns: Overbuilding the MVP by trying to include too many features, which delays feedback and increases the risk of building something users don’t want. Another anti-pattern is launching the MVP without a clear plan for how you’ll measure success and gather feedback.

Conclusion:

Achieving Idea Market Fit is the critical first phase in the journey of building a successful startup. It’s where your initial epiphany meets the realities of the market, and where your idea is stress-tested through rigorous conversations, detailed market analysis, and data-driven market sizing. The development of a Minimal Viable Product (MVP) serves as the ultimate validation of your hypothesis, providing real-world feedback that will shape the future of your product.

Throughout this phase, the importance of intellectual honesty cannot be overstated. Founders must be willing to question their assumptions, listen to tough feedback, and adapt based on what they learn. This is not the time for blind optimism; it’s the time for calculated risk-taking and disciplined execution.

By carefully navigating each stage—hypothesis, market analysis, market sizing, and MVP—you build a solid foundation for sustainable growth. This process helps mitigate go-to-market debt™, positioning your startup for the next phase of development with a clear understanding of your market, your customers, and the value your product offers.

Remember, the path to success is not linear, and challenges are inevitable. But by rigorously adhering to the principles of the Idea Market Fit phase, you increase your chances of building a product that not only resonates with the market but also stands the test of time. This is the bedrock upon which your startup’s future success will be built.

Thanks for reading folks 👊🏼

Wayne